ESG and Market Availability

CRE tenants consider ESG in varying degrees when making new office decisions. The biggest tenants consider it more than the local small business for 2 main reasons; resources and the cost. The good thing is that it is not out of reach as the below shows.

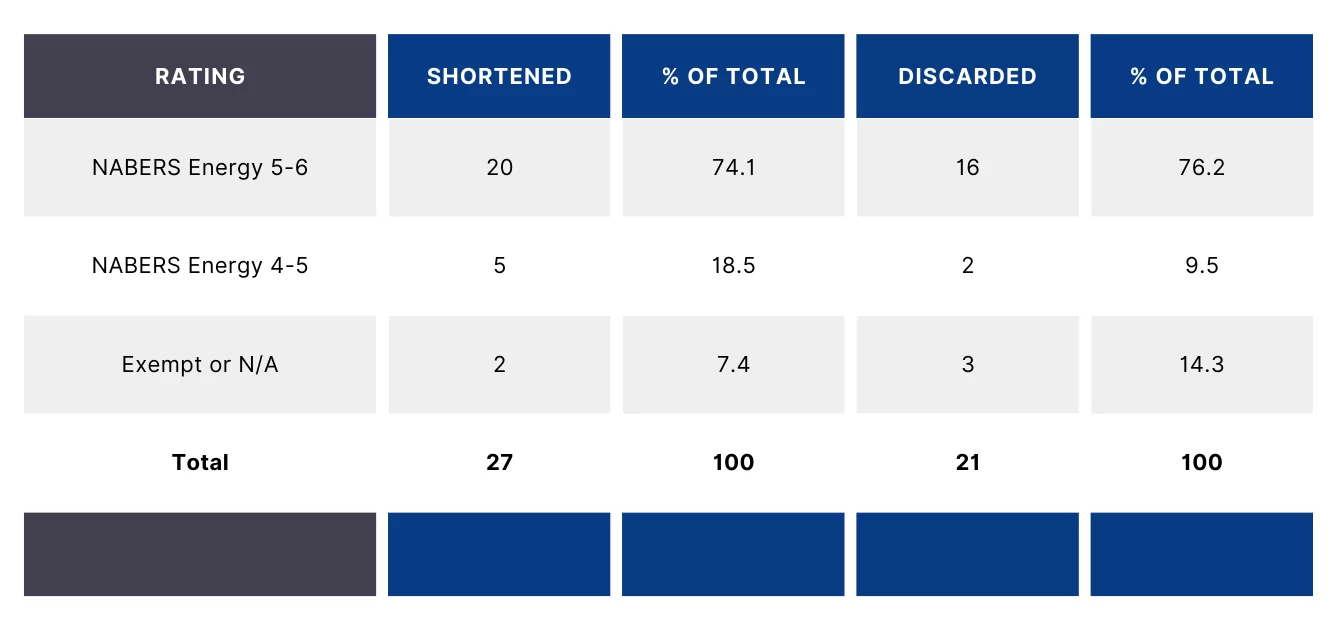

We analysed the properties submitted for a Sydney CBD client. 48 Buildings that could accommodate our client’s requirement (m2) were submitted. 27 made it onto the “shortened list”. 21 buildings were discarded because of our client’s specific requirements.

In order to assess the E in ESG of each building, we considered their NABERS Energy rating. These ratings, given by the National Australian Built Environment Rating System, act as a comparable measure and judge a building’s environmental performance. The 48 buildings faired as below:

Building grades ranged from C Grade to Premium Grade in both lists. Only 5 of 48 (~10%) did not have a rating. 5 of the 7 buildings with ratings of 4 or 4.5 were either A Grade or Premium Grade buildings.

Of course, the above is specific to this client but the data shows that ¾ of the buildings in the shortened and discarded list had NABERS Energy Ratings of 5 and greater whilst ¼ did not.

We did the same review for another client and the results were almost identical.

No Comments