Australian Capital CBD Office Markets Update

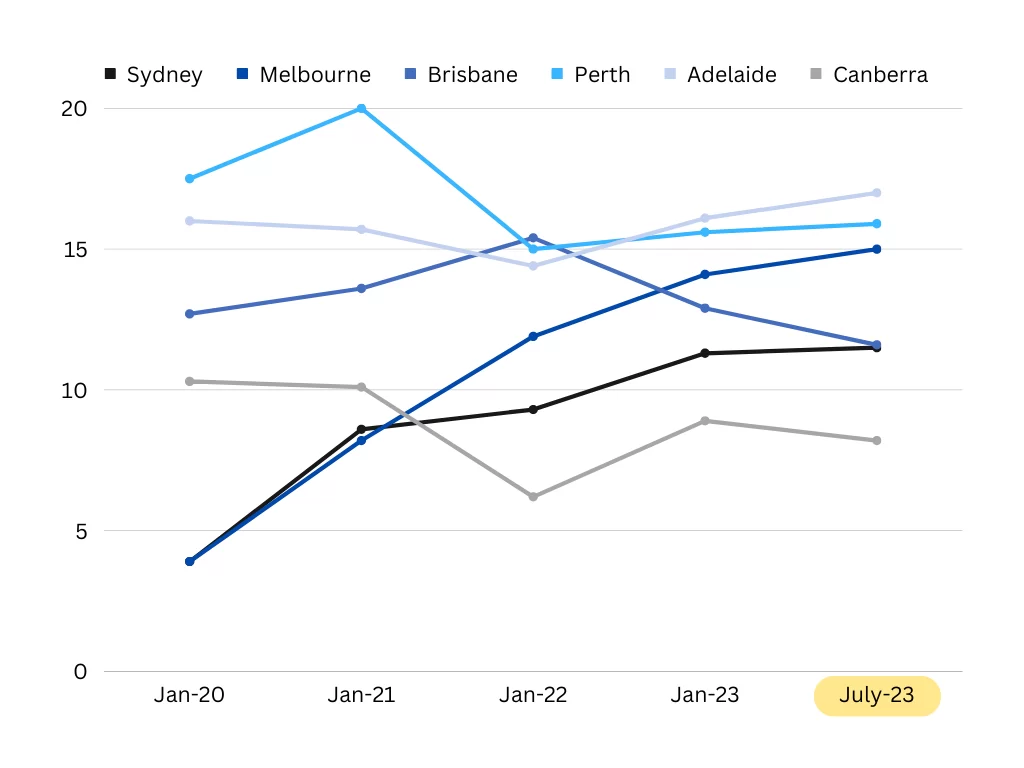

The Property Council of Australia released the office vacancy figures last week. National CBD vacancy increased from 12.6% to 12.8% and non-CBD markets saw vacancy increase from 15.2% to 17.3%. Overall, the markets are soft and it looks like this will continue for some time. Vacancy across the major capitals is now updated in the graph below.

The biggest 3 trends in the office markets are; vacancy remains high, bigger tenants are contracting, and SME’s are active.

Vacancy remains high

Of the capital cities, only Brisbane and Canberra experienced a decrease in vacancy. With more stock coming on-line and real absorption still very low, vacancy will remain high for some time. The non-CBD markets are not fairing as well. The excitement surrounding the suburban markets during 2020-2022 has dissipated. For Sydney, the vacancy figures are now the same as in the mid 1990’s.

Bigger tenants

The bigger the tenancy, the more process work involved and as a consequence the higher the number of people who are able to work from home. As a result, more large tenants will be decreasing their footprints over time by handing back space or subleasing. This is more apparent in the Western Corridor and Docklands precincts in Sydney and Melbourne respectively.

SME’s are active

The SME market is active across the board which is excellent for the overall economy. Most are right-sizing and leaving older premises. This follows the current drive to increase efficiency and productivity. So far this cohort has developed a good mix of WFH and work in the office.

No Comments