Australian Capital CBD Office Markets Update

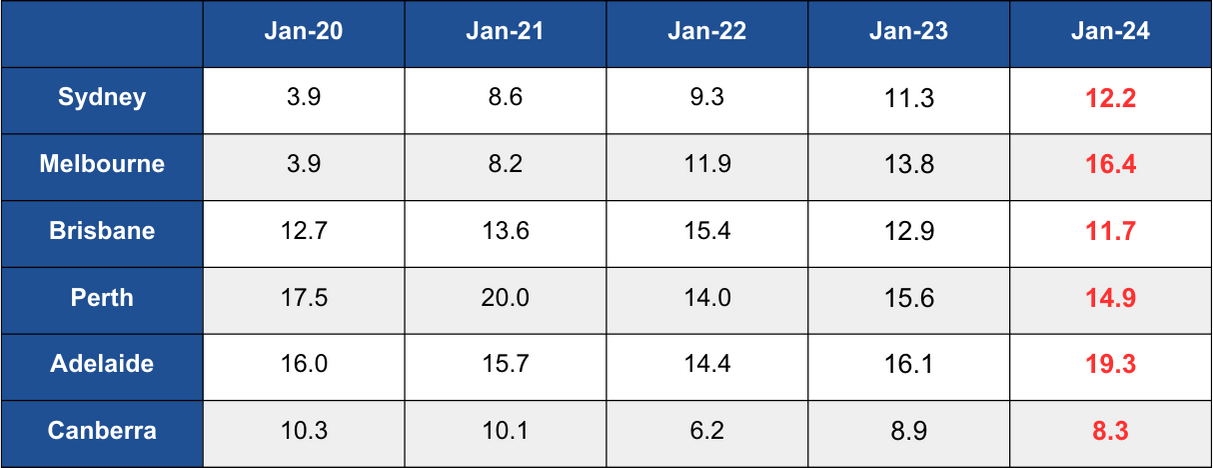

The Property Council of Australia released the office vacancy figures last week. According to their figures, total National Office vacancy increased to 14.8%, CBD vacancy increased to 13.5% and non-CBD vacancy increased to 17.9%. Overall, the markets remain soft and it looks like this will continue for some time. Vacancy across the major capitals is now updated in the graph below.

Very similar to the previous report 6 months ago, vacancy remains high, bigger tenants are contracting, and SME’s are active. The difference now is that we are in the flight to value phase.

Vacancy remains high

Of the 6 major capital cities, only Perth experienced a decrease in vacancy. With new supply still to be delivered and office tenants taking less space across the board, vacancy should continue to increase for the foreseeable future. Adelaide was the only CBD to experience positive net absorption (673 m2). Long-term average absorption continues to fall.

SME’s are active

The SME market continues to be active across the country which is excellent for the overall economy. Most are right-sizing and leaving older premises. This follows the current drive to increase efficiency and productivity. So far, this cohort has developed a good mix of WFH and work in the office and there is more right-sizing to come.

Flight to value

Some asking rents are now above market so price discovery will continue and tenants will seek better value. Many good quality buildings have just as much to offer as premium Grade buildings.

The biggest tenants

The bigger the tenancy, the more process work involved and as a consequence the higher the number of people who are able to work from home. As a result, more large tenants will be decreasing their footprints over time by handing back space or subleasing. This is more apparent in Sydney and Melbourne where the biggest tenants reside.

Repurpose older buildings

The debate about how to repurpose old office space continues. Cost of the real estate is the greatest barrier followed by legacy holdings. However, if values continue to fall, there may come a point where the pricing is right for repurposing.

We believe this will be the most fascinating year for some time.

No Comments