Australian Capital CBD Office Market

Earlier this year, I had the privilege of moderating the CoreNet Global, State of the CRE Market panels; Sydney, Melbourne, Brisbane, Adelaide and Perth. Canberra will hopefully be included in the next tour. Moderating these panels, absorbing audience insights, and talking to market participants provides a bird’s eye view of each of these capital city markets and in particular the two main drivers of office markets; vacancy and sentiment.

The vacancy data

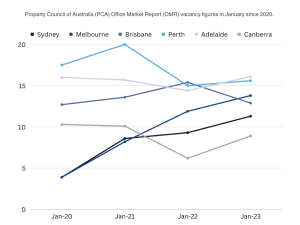

The graph below shows the Property Council of Australia (PCA) Office Market Report (OMR) vacancy figures in January since 2020.

The vacancy prognosis

Across all markets, vacancy will remain at elevated levels for the foreseeable future. Melbourne is expected to keep climbing for another 3 years. Canberra is not as elevated but is expected to increase towards 10% shortly. Adelaide Brisbane and Perth have had elevated vacancy for many years and current levels are close to normal.

High vacancy remains an issue for the markets. How do the landlords lease so much excess space? More importantly, what will they do with the older stock which may one day become obsolete. We will address these in future missives.

Sentiment

Overall, sentiment was positive but in varying degrees.

Adelaide was the most positive not only because it feels confident that it is adapting to the new work / office environment but also due to the upcoming defence contracts that will bring long term support to the CBD office community.

Brisbane had a spurt of demand in late 2022 and is now excited about the Olympics in 9 years but the office excitement seems has to have slightly waned.

Perth came out of Covid the strongest however there is some long term concern that the major mining companies continue to slowly reduce their number and footprints in the CBD. But there will be new miners (for new minerals) potentially taking up space in the future.

Sydney’s real demand has been weak for years. Finding a replacement sector for growth is proving difficult. Its high rents (double Melbourne) are going to be an impediment for the majority of tenants who cannot or will not afford the flight to quality.

Melbourne was least positive. Vacancy is high and predictions point to this continuing to increase over the next 3 years. It too will have an office demand problem but, it does have the most vibrant CBD after-work atmosphere which may be its saviour.

No Comments